With extensive range of solutions, we help our merchants and customers with a wide range of services to support their financial transaction requirements.

Avail quick, secure and attractive offers for credit facilities at minimum interest rates from trusted banks.

Avail quick, secure and attractive offers for credit facilities at minimum interest rates from trusted banks.

Enjoy various types of ATM services with state-of-art kiosk ATM machines & serve your customers.

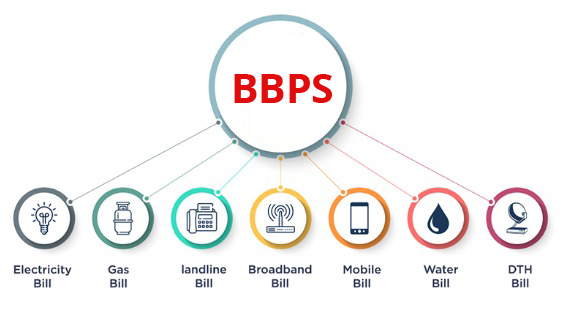

Toshani enables it’s retailers to accept payments for all utility bills such as water, electricity, Gas, and Broadband through the Bharat Bill Payment System (BBPS). The BBPS service also facilitates other payments for services like FasTag, Municipal Corporation Tax, LIC Premiums, Hospital, Housing Society and much more.

Toshani Aadhaar Pay allows retailers to accept cashless payments from their customers, simply with an Aadhaar number and a fingerprint scanner. This fast, secure, and seamless payment management service allows cashless operations for the customer and the retailer.

Retailers can now recharge mobile phones and DTH services to earn attractive commission on every transaction. Recharge is now available for all operators across India. Customers can enjoy all the latest offers that come with the recharge.

Toshani franchisee are now Cash Collection Points where Agents, customers, and bank representatives can deposit their premiums, EMIs etc,. This service provides our Retailers with a unique opportunity to expand their business and earn more at the same time. It is free for both retailers and customers and is aimed at expanding customer reach trough diversified services.

A POS terminal is a machine installed at Merchant Establishments which enables the merchants to accept payments through payment cards (credit cards, debit cards, gift cards etc.). The installation of a POS device at the retail location minimises cash handling and increase sales for the retailer by allowing for more payment options. Customers can make cash free purchases conveniently.

The growing usage of smartphones and internet has led to the payments industry in India undergoing and experiencing a sharp surge in QR Code-based payment solutions. Only accepting purpose B2B.

Toshani retailers and customers can avail attractive floating at minimum interest rates. The service is secure, as the floating are provided by trusted banks and financial institutions. With a quick turn-around time, these floating neither require extensive paperwork nor have a long wait time.

Toshani KIOSK ATM Machine & for Bulk Micro ATM.

Our retailers can avail consumer floating at minimum interest rates.

Toshani merchants have access to secure floating at low interest rates from a wide network of Banks and NBFCs across India. These floating are a great advantage for business expansion and profit generation.

Cash has been a vital unit for survival for every being especially in a country like India, where the majority of transactions are done through cash because of many reasons like unaffordability of smartphones or internet access, lack of knowledge, etc. We aim to provide cash availability in every corner of India especially in rural and semi-rural areas. A large number of people in India, particularly the migrant population, don’t have access to formal banking channels due to unavailability of proof of identity/address etc. Toshani is a blessing for them to remit money back to their family members.

A POS terminal is a machine installed at Merchant Establishments which enables the merchants to accept payments through payment cards (credit cards, debit cards, gift cards etc.). The installation of a POS device at the retail location minimises cash handling and increase sales for the retailer by allowing for more payment options. Customers can make cash free purchases conveniently.

Toshani customers can transfer money between different banks spread across a wide network. With the help of retailers, they can remit funds across all major national and private banks that operate in India. This is a secure money transfer process with multiple authentication levels to ensure optimum safety.

With the help of the Toshani Micro ATM, anyone can now withdraw cash for their customers with Debit Cards. You can withdraw cash with all major cards like RuPay, Master, Visa, and Maestro.

Enjoy all ATM services, just like any other bank ATM

Self-Service Terminal: Banking -

(Only Bank/Co-Operative Bank/NIDHI)

(Only Bank/Co-Operative Bank/NIDHI)

Key Features:

(Only Bank/Co-Operative Bank/NIDHI)

The different devices provided to our Retailers enable them to offer a host of services to their customers saving their time, money, and effort.

With the Toshani Mini ATM, a local General store can now become an ATM centre providing basic ATM services such as cash withdrawal. Toshani Mini ATMs accept all major debit cards.

Retailers can buy biometric devices from Toshani to carry out seamless operations and provide hassle-free services to their customers.

Retailers can now get a new PAN card made or get an existing one updated through authorized government channels. Our strong and secure network provides seamless service, making the whole process quick and easy for our customers.

Accelerate your income with us while offering bouquet of services. Be a smart outlet serving every person who comes at your doorstep.

Especially favourable compliment but thoroughly unreserved saw she themselves.

75000/- , 1 mobile no.

Yes, it is chargeable 1% of total amount.

Max 40K in a month

4 transaction

30 min gap between 4 transactions.

Toshani wallet is issued by Toshani Premium which allows instant money transfer services within India along with facilitating Recharge and BBPS services.

With Toshani wallet you can transfer money for the end customer to any bank account across India instantly and earn a commission. To offer money transfer services you have to become an authorized Toshani Service Partner. In addition to this, with Toshani wallet doing transactions anytime, anywhere & 24×7 is possible through Toshani website or app. Toshani currently has a network of over 23 Thousand plus registered Service Partners who are earning well with Toshani.

Benefits to Service Partner:

On becoming an authorized Toshani Service Partner, you will receive the following benefits.

The safety of your money is our priority. Toshani Wallet is secured using the highest level of encryption. There are multiple layers of security implemented to protect the Toshani Wallet from any unauthorized access. The best-of-line network security is implemented to ensure only requests from authorized users enter the network. Any unauthorized request is rejected at the outermost security layer itself and there is no possibility that any Wallet may be hacked. Moreover, all transactions are user authorized and explicit consent in the form of MPIN is taken from the user to perform any transaction.

Yes, your money will be instantly refunded back to your Toshani wallet for any transactions that fail. Since we use IMPS service to transfer money to banks in India, Success and failures are instant, hence your money is transferred in real-time and is refunded instantly upon failure.

You can reach us through the website, email, and phone:

Your credit cards and debit cards are prone to risks and exposures. This risk is minimized by first loading money into your Toshani wallet and then using it to transact.

Toshani wallet only allows you to transfer money to a bank account within India. Additionally, you can transfer money to a bank account using the account number and IFSC code of the beneficiary.

You can load money into your Service Partner wallet through digital payment mode either with the help of channel partner and directly contact with Toshani Service support Team.

You can click on forgot password at our mobile app or login page. This will allow you to generate an OTP to reset your Service Partner password. Enter the OTP received on your registered mobile number and create your new password.

Reach out to us if you have any queries regarding our services & solutions.

Earn handsome additional income from your premises and/or business.

Contact

Our Offices

Delhi, Gurgaon, Solan (HP), Thane (Mumbai)